The content of the course aims at making the student familiar with fundamental principles and methods for modelling of financial markets and for pricing of financial derivatives. The main focus is on models in discrete time and simpler continuous time models.

More precisely the following is part of the course:

- Binomial models in one and multiple periods

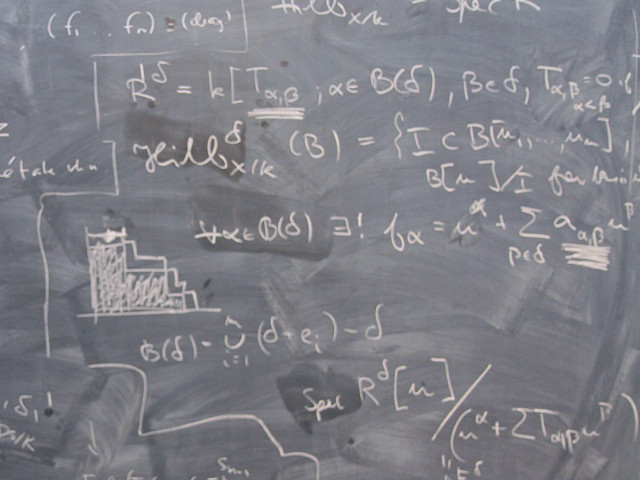

- Modelling of arbitrage free financial markets in discrete time

- Replication and arbitrage free pricing of financial derivatives in discrete time

- The first and second fundamental theorems for asset pricing (FTAP)

- Basic financial derivatives and products such as forwards and futures

- Black Scholes model in continuous time and the Black Scholes pricing formula

- Modelling of interest rate markets and pricing of interest rate derivatives