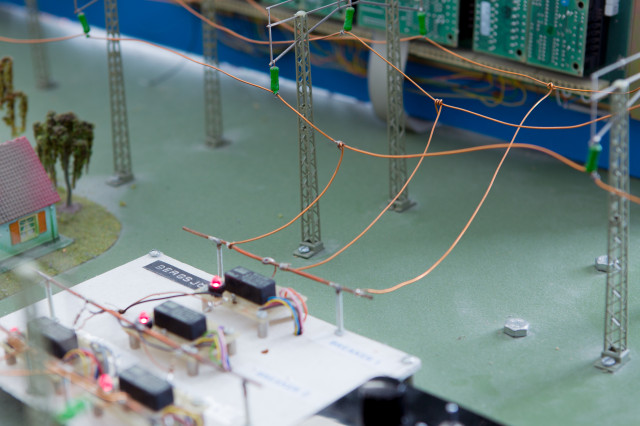

• Introduction to electricity networks

◦ Introduction to electric power systems

◦ Introduction to microeconomics

◦ Introduction to electricity markets

• Optimal dispatch

◦ Efficient dispatch of electricity generation with no transmission constraints

◦ Market-based dispatch of electricity generation with no transmission constraints

◦ Efficient dispatch of electricity generation with transmission constraints

◦ Nodal-Zonal-Regional pricing

• Managing risk

◦ Basic concepts

◦ Hedging with no transmission constraints

◦ Introduction to electricity markets

• Market power

◦ Introduction to market power

◦ Market power, nodal pricing, and transmission congestion

◦ Market power in wind-integrated power systems

◦ Measuring, forecasting, and mitigating market power

• The generation investment decision

◦ Efficient investment in electricity generation

◦ Market-based investment in electricity generation

• Transmission regulation, investment, and planning

◦ Introductory concepts

◦ Efficient coordination of transmission and generation investment

◦ Is there a role for market-based transmission investment?

◦ The transmission planning problem

◦ The transmission regulation problem

• Electricity Market Lab

◦ Workshop on PLEXOS for Power Systems

◦ A series of home projects on different electricity market issues

▪ CO2 market and Financial Markets

▪ Market power and game theory

▪ Optimal Power Flow and Zonal/Nodal Pricing

▪ Hydro Power Planning

▪ Generation and Transmission Planning

▪ Transmission pricing